PERFORMANCE AND RESULTS FOR 2022

Key Performance Indicators 1:

|

Millions of euro unless otherwise stated |

2022 |

2021 |

Difference |

Difference (%) |

|

Results |

|

|

|

|

|

Business turnover |

514 |

243 |

271 |

112% |

|

EBITDA |

65 |

(51) |

116 |

- |

|

EBITDA margin/turnover |

12.6% |

(21.2%) |

33.8 |

- |

|

Net results |

43 |

(65) |

108 |

- |

|

Cash flow and debt |

|

|

|

|

|

Cash flow from operations |

41 |

(38) |

79 |

- |

|

Net cash flow |

18 |

57 |

(39) |

- |

|

Net financial debt |

293 |

300 |

(7) |

(2%) |

|

Net financial debt/EBITDA |

4.5x |

(5.9x) |

- |

- |

|

Cash and cash equivalents |

95 |

77 |

18 |

23% |

|

Other |

|

|

|

|

|

Order book |

303 |

177 |

126 |

71% |

|

CapEx |

14.7 |

6.7 |

8.0 |

119% |

Business development

Tubos Reunidos closed 2022 with consolidated revenue of € 524m and a turnover of € 514m, doubling the 2021 figures and achieving the best results in recent years. This substantial improvement is based on a significant rebound in demand and the impact that the overall increase in production costs has had on sales prices in the sector.

Our activity has been heavily focused on carbon steel piping, for three main reasons: an initial portfolio in January 2022 with a significant weighting of commodity products due to the replenishment of inventories by customers and the distribution chain throughout the previous year; the strong inflow of carbon steel orders from oil and gas in the United States throughout the year; and ongoing sustained inflows of orders for pipes for large-scale mechanical and industrial uses. The main European markets, having taken the full impact of the reduction in gas supplies from Russia and focused on the need to boost investment to reduce their dependence on that country, have also shown very good performance, with strong demand and favourable price trends.

.png)

By geographic area, sales to North America have increased to €252m, representing 53% of the Group's total revenues, compared to 25% in 2021. High oil and gas prices have accelerated investments in major shales, sharply increasing demand for OCTG piping in the US throughout 2022 from 3.5 million tonnes in 2021 to 4.6 million tonnes in 2022. In this context, the Group was able to react with sufficient agility to reactivate its production capacity that had been shut down during the pandemic.

Moreover, the agreement reached by the US and European Commission administrations to establish tariff-free quotas for steel and aluminium exports has boosted sales in the United States, also supported by high prices due to the lack of capacity in the local market to service domestic demand.

These factors have allowed us to supply material again to RDT, our product finishing plant in the United States, recovering positions in our main market by winning large piping contracts with its BTX connection throughout the year. Additional orders have also been won for TRPT, the pipe joint venture with premium connections. In parallel, pipeline procurement in the United States has also been at very high levels, and all at historically record sales prices.

The high volume of exports outside the European Union has also benefited from the appreciation of the dollar against the euro.

The main European markets, having taken the full impact of the reduction in gas supplies from Russia and focused on the need to boost investment to reduce their dependence on that country, have also shown very good performance, with strong demand and favourable price trends.

On the other hand, we are still to see a revival in other areas. Demand for orders from China, still affected by restrictive policies to deal with successive outbreaks of COVID-19, has been weaker than expected, while projects that have started up in the Middle East have done so at unattractive prices for foreign manufacturers, who are unable to benefit from the region's low energy costs.

Sales growth has occurred in all business sectors: upstream (OCTG) accounts for 33% of total turnover, with a 439% increase on 2021, based on the recovery of the North American market to pre-pandemic levels, but with much higher prices. Secondly, pipes for mechanical-industrial applications are noteworthy, with an increase of € 68m in turnover, 112% with respect to 2021. There are also increases in downstream sales, 8% on 2021, and midstream 110% compared to a 2021 with very little activity.

In relation to projects related to electric power generation, refining and petrochemicals (downstream) that provide a mix of alloyed and stainless steels, although there has been some reactivation of projects paralysed by the pandemic, the impetus we expected in the major markets in Asia and the Middle East has not yet been recovered.

Order book

The strong increase in demand for drilling and driving in North America and the contraction of a significant portion of traditional supply, as a consequence of the anti-dumping provisions in the country, have meant that, throughout the year, the order intake has continued to gain momentum month-on-month. Growth has been remarkable in volume but especially in sales prices, which have shown an upward trend as we have been able to progressively pass on the strong increases in energy and raw material costs to the market, and subsequently to maintain them despite the high volatility, to end 2022 with a product portfolio of €303m, up 71% from the beginning of the year. This marks a record level, especially with a highly concentrated mix of carbon and low alloy steels in the OCTG and mechanical segments.

Consolidated Statement of Income

|

Millions of euro |

2022 |

2021 |

% difference |

|

Net turnover |

513.7 |

243.0 |

111% |

|

Other operating income |

10.1 |

7.8 |

29% |

|

Operating income |

523.8 |

250.8 |

109% |

|

Change in inventory of finished products and those in production |

23.6 |

27.4 |

(14%) |

|

Supplies |

(206.9) |

(132.4) |

56% |

|

Staff expenses |

(101.9) |

(102.9) |

(1%) |

|

Other operating expenses |

(174.4) |

(94.7) |

84% |

|

Other net profit/(loss) |

0.4 |

0.3 |

33% |

|

EBITDA |

64.5 |

(51.4) |

- |

|

Turnover margin |

12.6% |

(21.2%) |

|

|

Depreciation of property, plant and equipment |

(15.8) |

(13.1) |

21% |

|

Impairment and results for fixed assets disposal |

5.3 |

77.4 |

(93%) |

|

Operating income |

54.0 |

12.9 |

319% |

|

Turnover margin |

10.5% |

5.3% |

|

|

Financial results |

(16.0) |

(77.6) |

(79%) |

|

Tax on profits |

5.5 |

0.1 |

- |

|

Result attributed to external partners |

0.01 |

0.01 |

- |

|

Result attributed to the parent company |

43.5 |

(64.7) |

- |

|

Turnover margin |

8.5% |

(26.6%) |

|

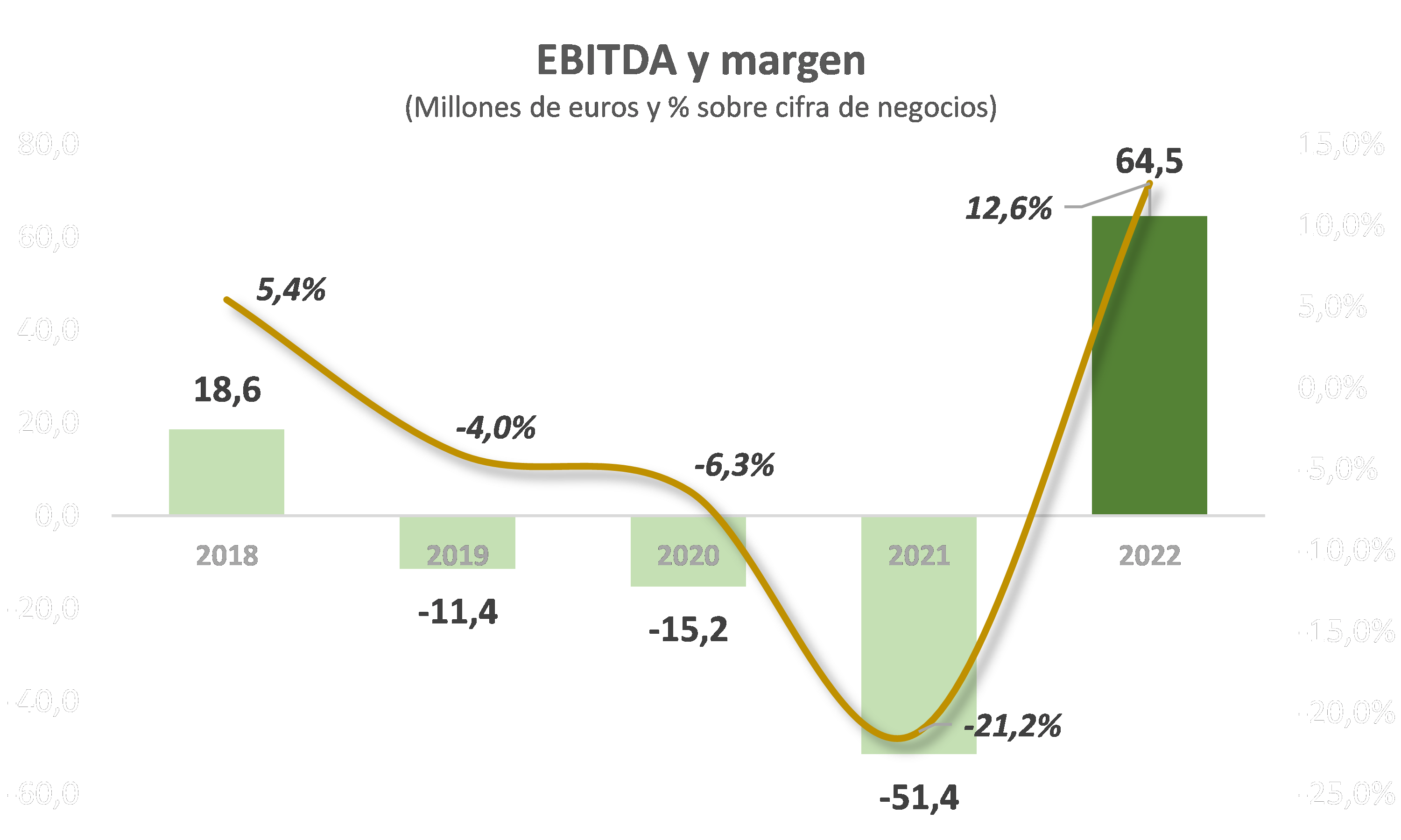

The positive trends in sales, together with the start of the efficiency measures envisaged in the Strategic Plan and the appreciation of the dollar against the euro, have led to a significant improvement in consolidated results. The Group has therefore achieved a positive EBITDA of € 64.5m, a remarkable turnaround from the negative € -51.4m in 2021 and even compared to the positive € 18.6m in 2018, the first year of the introduction of the tariff in the United States. For its part, the Group's consolidated operating profit amounted to € 54.0m compared to € 12.9m in the previous year (the 2021 amount that includes an non-recurring positive effect due to the reversal of impairment of fixed assets of € 77.4m).

Production costs have been affected by the geopolitical and macroeconomic environment. Russia and Ukraine are among the world's leading suppliers of the basic raw materials for the manufacture of steel pipes, including scrap metal and various ferroalloys. All of them had already been experiencing price rises throughout 2021, which the conflict and the consequent sanctions adopted against Russia by the international community have significantly worsened. While this trend appears to have eased in the second half of the year, the effect on production costs in 2022 as a whole has been very noticeable.

The dynamics have been similar in the prices of gas and electricity, two key inputs for steel smelting processes, as well as for the rolling and finishing of pipes, which have been extraordinarily bullish due to the reduction in supply, the risk added by the conflict, amplified in the European Union by the increase in the price of CO2 rights. To manage these impacts, the Group's policy has focused on supply assurance and operational measures to optimise production in order to reduce consumption per tonne produced.

The variation in staff expenses is affected by the inclusion of expenses associated with the strategic initiatives launched under the Strategic Plan in 2021, and also by the lower expenses derived from the Temporary Lay-Off Plans that affected part of the workforce last year. Without this effect, there is an increase in staff costs as a consequence of the higher level of productive activity, the reactivation of the US plant and the raise in salaries to reflect the impacts of the CPI.

The Group’s net consolidated financial expenses for the year amounted to a cost of €16.0m (2021: 77.6 million euro, 19.1 million euro excluding the non-recurring effects recorded in the year). Interest expenses on debt amounted to 21.5 million euro (2021: 21.8 million euro). Of this, €4.6m corresponds to the equity loan from the FASEE (Fondo de Apoyo a la Solvencia de Empresas Estratégicas — Solvency Support Fund for Strategic Companies), including €1.2m of equity interest which accrues only in the event that the Group obtains positive EBT, and the remainder, for the most part, to the various tranches of syndicated financing with various entities. The strong dollar has had a positive impact on exchange rate differences of €1.8m (2021: positive €2.7m). Finally, the financial expenses reflect the positive impact of the valuation and settlements of a financial PPA for the purchase of electricity from renewable sources signed at the beginning of 2022 in the amount of €3.7m.

As a consequence of the improved results and business prospects in the coming years, the Group has recognised €6.1m of deferred tax assets. The Group also has tax loss carry-forwards and deductions not recognised on the balance sheet amounting to over €300m.

These results have enabled the Group to close the year with a net profit of €43.5m (compared to €64.7m losses in 2021), the highest since 2008, in addition to confirming the recovery trend and compliance with the Strategic Plan.

Cash generation and net debt reduction

Cash generation was positive, with an operating cash flow of €40.8m, a net cash flow of €17.5m and available cash position at year-end at €95.1m. Net debt was reduced by €6.7m to €292.8 m at year-end, 4.5 times EBITDA.

.png)

As at 31 December 2022, the Group's gross financial debt (bank borrowings and FASEE equity loan) amounted to €390.3m (€392.2m at nominal value net of interest and amortised cost adjustments).

In 2022, the Group has repaid a total €11.4m of structured financing, complying with the schedule agreed with the banks in the last novation of the loans in 2021. It should also be noted that due to the generation of positive results, the interest-sharing component of the SEPI loan has accrued in the amount of €1.2m, which will be paid in the first quarter of 2023.

As at 31 December 2022, the Group is in compliance with the covenants established in the financing agreements: net debt/EBITDA and maximum authorised CapEx.

Investments

Under the auspices of the funds received and within the framework of the Strategic Plan, a series of major projects have been undertaken to transform the company, in line with the objectives of the ecological transition, reorienting its commercial focus, designing future investments to increase operational, energy and environmental efficiency, reinforcing ESG (environmental, social and governance) goals, improving the Group's management, services and image with our customers, including a change in our corporate identity to incorporate the name Tubos Reunidos Group.

Within these projects, in 2022, there are two that have been undertaken that have a marked transformational nature due to the synergies that can be achieved in the production processes: firstly, the joining of the cold-drawing units of the Pamplona and Amurrio plants on the last one, now already complete, and, secondly, the concentration of the casting processes of the Trapaga and Amurrio steel mills on the last one thanks to an investment of over €11m that will allow both billet and ingots to be manufactured in the same facility, the raw materials needed for the manufacture of pipes of different diameters and compositions.

The unification of the two steel mills, which is expected to be completed by the end of the first half of 2023, will, in addition to substantially increasing usable capacity and generating significant energy improvements, allow for a more efficient steel casting process by optimising bottlenecks. This action includes, in a second phase to be executed in 2024, the implementation of an AOD (argon oxygen decarburisation) process that will allow the use of lower cost ferroalloys without compromising quality.

Outlook for 2023

The performance of 2022 allows us to face 2023 with confidence, as we have a portfolio volume of 303 million euro and a market that is giving favourable indicators from the demand point of view, along with the challenge of managing uncertainty and possible cost volatility. Our strategy affords us greater efficiency in our internal management, through weighting the portfolios and product mix best suited to our facilities and production process.

Finally, the need to promote the ecological transition towards a sustainable economy is an opportunity for the Tubos Reunidos Group. In addition to being a key industry in energy transmission, the Group is opening new lines of development for both process improvement and new applications related to clean energies, and, in particular, to the hydrogen value chain, areas that are expected to increase the sales portfolio in the future.

ANNEXES: SUMMARY OF FINANCIAL STATEMENTS

.png)

.png)

Information and forward-looking statements

The financial and operational information included in this report for FY 2022 is based on consolidated financial statements. This document has been prepared by TUBOS REUNIDOS, S.A., and is distributed for information purposes only. This document contains forward-looking statements and includes information regarding our current intentions, beliefs or expectations about future trends and events that could affect our financial condition, the results of operations or our share price. These forward-looking statements are not guarantees of future performance, and entail risks and uncertainties. Therefore, actual results may differ significantly from the forward-looking statements due to various factors, risks and uncertainties, such as economic, competitive, regulatory or commercial factors.

Both the information and conclusions contained herein are subject to change without prior notice. TUBOS REUNIDOS, S.A. is under no obligation to publicly update or revise forward-looking statements, whether as a result of new information, future events or otherwise. Actual results and developments indicated could differ significantly from those indicated in this document.

[1] The definition of the indicators can be found in the "Alternative Performance Measures" section of the Management Report for the consolidated financial statements for FY 2022