Tubos Reunidos ends 2023 with EUR 533 million in Revenue and EUR 56.3 million in net income

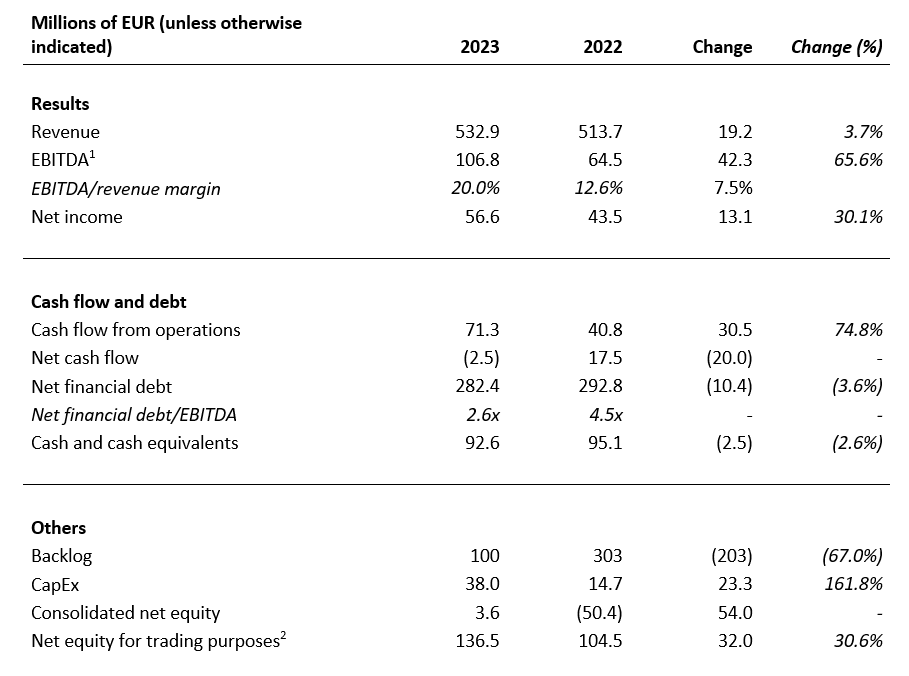

Amurrio, Spain, 29 February 2024 —Tubos Reunidos Group today published its results for the 2023 financial year, improving previous year results, confirming the trend seen in the first half of the year. Revenue totalled EUR 533 million, a 3.7% increase compared to 2022.

The Company's progress in 2023 was characterised by very good performance in the first half of the year, based on the high prices seen in the seamless pipe market during the final months of 2022, and by weaker demand in the second half of the year due to the high level of stocks held by distributors and end customers, which resulted in a slowdown in incoming orders.

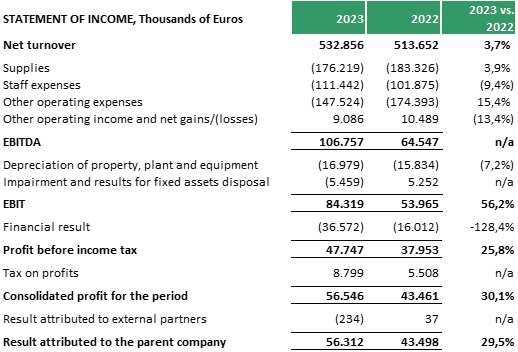

This positive sales performance was accompanied by a moderation in the prices of some of our main expenses and progress with the efficiency actions set out in the Strategic Plan, resulting in high profitability margins. Thus, the Company achieved earnings before interest, taxes, depreciation and amortisation (EBITDA) of EUR 106.8 million, which was 65.6% more than in 2022, with a profit margin of 20% on revenue.

[1] The definition of the indicators can be found in the "Alternative Performance Measures" section of the Management Report for the consolidated financial statements for FY 2023

[2] Of the Group's parent company

The consolidated financial result for the year is minus EUR 36.6 million, compared to EUR 16.0 million the previous year, as a result of the increase in interest rates, the unfavourable trend of the EUR/USD exchange rate and the impact of the valuation of the financial PPA. The net expense of interest on our debt and the use of the working capital financing facilities has increased to EUR 27.6 million (2022: EUR 21.5 million) as a result of the increase in interest rates affecting a part thereof, which is linked to variable rates. Of this, EUR 7.9 million corresponds to the equity loan from the FASEE (Fondo de Apoyo a la Solvencia de Empresas Estratégicas — Solvency Support Fund for Strategic Companies), including EUR 1.2 million of equity interest which accrues only in the event that the Group obtains positive results, and the remainder, for the most part, corresponds to the various tranches of syndicated financing with various entities.

Thus, the net result is EUR 56.6 million, compared to EUR 43.5 million in the previous financial year.

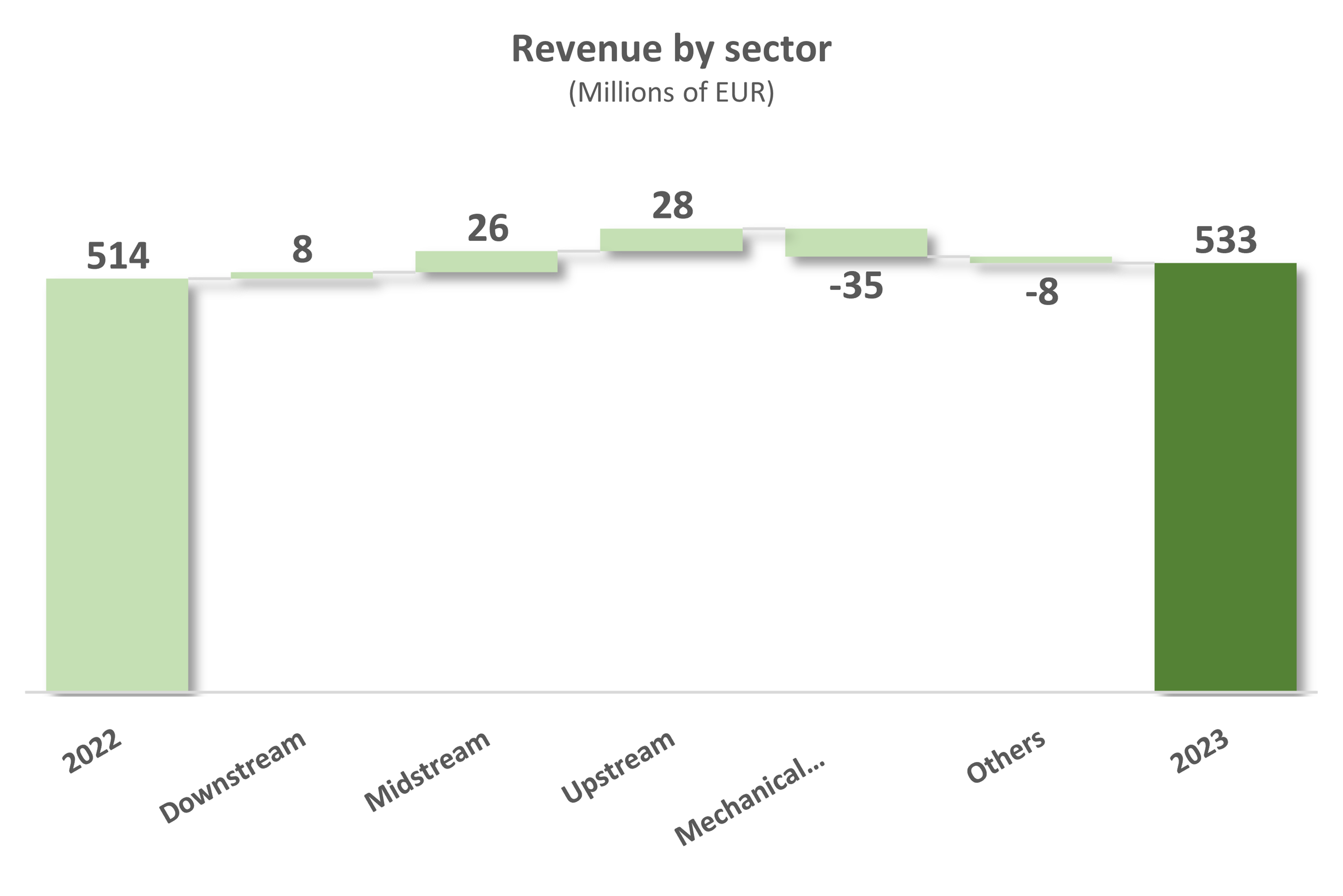

Consolidated pipe revenue by markets and business sectors, and business trends:

USA remained the Company's biggest market, with sales of EUR 245 million, representing 46% of the Group's total revenue, compared to 54% in 2022. High oil and gas prices, the slowness in the recovery of the local supply of pipes in the USA and the need to carry out investments after several years of reduced activity strongly boosted orders from distributors and end companies in 2022, which resulted in a high level of invoicing in this financial year.

It should also be noted that, in December 2023, the US Government extended the tariff quota rate for imports of steel and aluminium from the European Union until 31 December 2025, which ensures that access to the main OCTG market remains possible under less restrictive conditions.

All these factors have enabled us to maintain a high volume of sales to North American customers, both through direct shipments of pipes manufactured and treated at the Amurrio and Trápaga mills and through pipes for which the final finishing phase has been carried out by our RDT mill in Texas. For its part, the TRPT mill has also seen strong levels of production of pipes with premium connections.

The rest of the markets have behaved very positively and grown compared to 2022, with the increase in sales in Europe (especially due to high price levels), the Middle East and Africa standing out.

By sectors, upstream and midstream sales have increased due to the effect of prices, while pipes for mechanical-industrial applications in the small pipe range have decreased, which was to be expected after having reached a high price level in 2022.

As for tubes and pipes with dimensions exceeding 8", which are produced in the Trápaga mill, the Company has had a good 2023 financial year thanks to high demand for mechanical piping, together with a satisfactory performance for special carbon pipes, which have been used as structural piping in projects in which the required dimensions have allowed us to maintain prices. Stainless steel pipe production has been lower, although with a high profit margin despite the lower volume. It should be noted that high inflation and high financial costs have delayed the award of projects in the energy sector, which has affected the sales of some "premium" downstream products.

Backlog:

The pressure on demand for piping due to the combination of various factors throughout 2022 resulted in an overstock in distributors’ and end customers’ warehouses, which has resulted in a slowdown in orders for much of this last year, with the result being a reduction in the backlog at the end of 2023. However, underlying demand remains strong and market trends predict growth in seamless pipe consumption over the next few years. On this basis, we hope that in 2024 the overstocking situation will be resolved, and demand will recover.

In turn, the reduction in the number of producers in Europe who manufacture larger pipes, following the closure of the Vallourec mills in Germany, provides opportunities for growth in that market segment. However, these opportunities are affected by competition from Chinese and Ukrainian producers, with a significant impact on some varieties, such as mechanical piping, in relation to which we are seeing a strong trend towards downward price normalisation.

Financial situation:

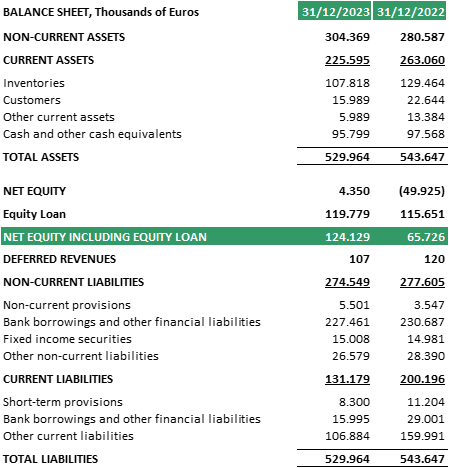

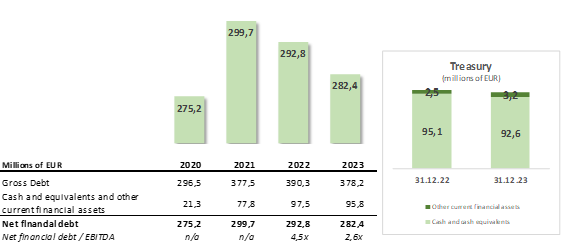

The Group generated an operating cash flow of EUR 71.3 million in the year, which has allowed it to pay for investments amounting to EUR 33.2 million and, in addition, to amortise EUR 18.6 million of principal of the syndicated financing, including the early cancellation of all ICO funding received in 2020, which represents an improvement in terms of compliance with the repayment schedule agreed with the entities in the most recent debt refinancing in 2021. The Group also ended the year with a solid cash position, with a lower use of its working capital financing facilities and improving its net financial debt, which stood at EUR 282.4 million as at 31/12/23, equating to a reduction of EUR 10.6 million over the year.

Net debt has developed as follows over the last four financial years:

Cash generation has also enabled the Group to acquire convertible debt from its creditors through a discounted reverse auction procedure carried out in January 2024. Specifically, the Group has paid EUR 27.5 million to acquire principal and interest in tranches B and C and in class B bonds for a total amount of EUR 106.7 million—an average discount of 74%—generating financial income and a EUR 65.3 million reduction in net debt. The accounting impact of this transaction on the Group's debt, equity and result will be recognised in 2024.

Investments:

The Group ended 2023 by commissioning the extension of the Amurrio steel mill for the production of ingots for large pipes, which until that point had been produced in Sestao. The first units intended for the Trápaga mill were successfully smelted in October and, since 1 January 2024, all the Group's steel production has been carried out entirely in the new steel mill. This work is one of the pillars of the Strategic Plan, as it makes it possible to unify the first phase of the pipe manufacturing process in a single location, with the resulting cost efficiencies. In addition, the new facilities will make it possible to extend the size range of large pipes manufactured to 30".

For its part, the RDT mill in Texas has installed a new line, enabling it to double its annual threading capacity with semi-premium couplings owned by BTX, which offers superior performance and reliability in difficult environments. In addition, investment has begun in the mill that will also allow the heat treatment of pipes to be doubled compared to the capacity of the current facilities. This increase in heat treatment capacity is essential in a phase of the process in which there is a significant concentration of supply and which has become one of the main limiting factors in reaching US customers.

Finally, using the funds received and within the framework of the Strategic Plan, the execution of various projects aimed at driving the Company's transformation is ongoing, aligning it with the objectives of the ecological transition, reorientating its commercial approach, increasing digitalisation, designing future investments to improve operational, energy and environmental efficiency, bolstering ESG objectives, and improving the Group's management.

Outlook for the 2024 financial year:

After an exceptional 2023 financial year, albeit one that saw a gradual decrease in the backlog throughout the year, we anticipate that 2024 will see a normalisation of volumes and prices, with the financial year being characterised by a first half of lower activity and a gradual recovery in demand throughout the year, although it is difficult to envisage prices recovering to reach the levels seen in the last year.

2024 has started with a high degree of uncertainty and a macroeconomic environment that remains characterised by relatively high inflation and a belief that interest rates will remain high for longer than expected. In Europe, the German economy has still not fully recovered, which may have a negative impact on other EU countries. Moreover, the significant inflow of pipes imported at low prices is a factor that must be taken into account, insofar as it adds additional pressure to a sluggish market situation.

In the US, the focus will be on the November 2024 elections, the outcome of which will determine whether the current scenario is likely to continue or whether there will be a possible return to a policy focused on the domestic market that again adopts protectionist measures favouring local industry. In any event, the extension of the current scheme of duty-free quotas and exemptions for imports of steel and aluminium, until December 2025, is positive news that allows us to face these next two years with reasonable optimism. In addition, demand for pipes used in drilling and carrying is expected to recover as current stock surpluses held by both distributors and end customers are reduced.

Finally, as set out at the recent COP28 summit in Abu Dhabi, the firm commitment to sustainability and to reducing emissions, which gives us an opportunity to consider relaunching investments to underpin the energy transition, is worthy of note. In this respect, Tubos Reunidos's commitment to being an important stakeholder in the production of low-emission pipes places us in a prominent position in the minds of customers who are increasingly aligned with this transition. A portion of our production in 2024 will focus on low-emission pipes, in order to generate value for our customers on their pathway towards decarbonisation and to strengthen a segment that will undoubtedly be one of the key areas of growth and value generation in the near future.

Exit of the Executive Chairman and appointment of a new Non-Executive Chairman:

In the area of governance, the separation of the positions of Non-Executive Chairman and Chief Executive, in line with best practices of good corporate governance and with the aim of strengthening the independence of the Board of Directors, should be noted. Thus, following the voluntary resignation of the former Executive Chairman Mr Francisco Irazusta, with effect from 31 August 2023, the Board decided to separate the positions of Non-Executive Chairman and Chief Executive and ratify the appointment of Mr Carlos López de las Heras as Chief Executive of the Tubos Reunidos Group with effect from 31 August 2023. Similarly, on 21 December 2023, Mr Josu Calvo Moreira was appointed as an Independent Director of the Company by means of co-optation, as well as Non-Executive Chairman of the Board of Directors.

Appendix: Summary of financial statements