Tubos Reunidos maintains a net profit of 40.6 million euros in a complex scenario of slow market recovery of slow market recovery

- The company reduced its net financial debt by a considerable EUR 62.1 million in the first half-year.

- EBITDA was EUR 5.3 million in the first six months of the year, with demand extremely low as a result of high inventory levels and political and economic uncertainties brought about by conflicts in various parts of the world and elections in several key economies.

- This excess supply is mainly due to ultra-low-cost Chinese products as suppliers there look abroad for demand owing to difficulties in their local market.

- Revenue in the period up to 30 June totalled EUR 172.7 million.

- At the end of the first half of the year, the order book was similar to how it was at the end of 2023 as a result of stagnant markets in Europe and, in particular, the United States.

- The Strategic Plan continues to be implemented satisfactorily, with the milestones it sets out being achieved despite this challenging environment.

Amurrio, 27 September 2024. The Tubos Reunidos Group has today published its results for the first half of the 2024 financial year. The results demonstrate improved efficiency in a market beset by uncertainty and with stagnant international demand. It is undoubtedly one of those slowdowns characteristic of an extremely cyclical sector like seamless piping.

In the first half of 2024, the Group's revenue totalled EUR 172.7 million, EBITDA amounted to EUR 5.3 million and net profit was EUR 40.6 million due to the accounting effect of the debt buyback performed in January.

The Tubos Reunidos Group purchased convertible debt from its creditors through a discounted reverse auction that took place in January 2024. Specifically, this entailed acquiring principal and interest totalling EUR 106.7 million, paying EUR 27.5 million and generating financial income and a net debt reduction of EUR 65.3 million.

In view of the outlook in terms of incoming orders over the months ahead, the temporary redundancies (under the programme known as ERTE) for production reasons will remain in place until December.

Financial situation

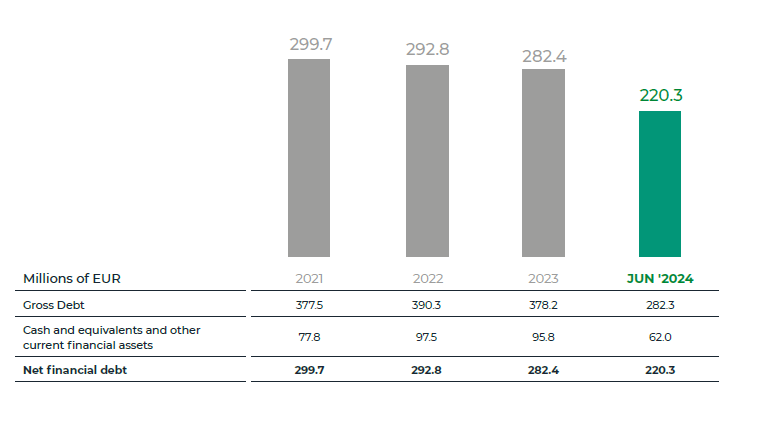

Net financial debt fell by EUR 62.1 million to EUR 220.3 million (31/12/2023: EUR 282.4 million).

The debt buyback involved the Group making an offer to its creditors via a discounted Dutch auction, which entailed purchasing debt with a nominal value of EUR 106.7 million of principal and interest, paying EUR 27.5 million and reducing net financial debt by EUR 66.5 million (taking into account accounting effects and costs).

Ongoing efforts to optimize working capital enabled the generation of an operating cash flow of EUR 14.7 million. Investments, mainly made as a result of unifying the steelworks, stood at EUR 13.1 million. In terms of debt servicing, EUR 5.8 million was allocated to repaying the principal on the syndicated loan and the FASEE loan.

The evolution in net financial debt over the last four years is as follows:

Strategic Plan

The Strategic Plan continues, and the most notable elements to be implemented were:

- Unification of the steelworks in a single location. This is the cornerstone of the Strategic Plan and a decisive step towards decarbonization. The Group's new steelworks has been fully operational since the beginning of the year.

- Unification of the cold-drawing plants in a single location, pooling knowledge and developing a cutting-edge plant that allows us to develop the products needed for our customers' energy transition.

- Expansion of the product range at the Trápaga plant and development of heat treatment and threading capabilities at the RDT plant in Texas (USA).

- April 2024 launch of the O-Next brand of net zero scope 1 and 2 CO2 emission pipes.

- Implementation of the Digitalization Plan.

- Reorganization of the Tubos Reunidos Group's real estate assets

O-Next

Tubos Reunidos is producing the first 2000 tonnes of this seamless piping with 0.0 kg of CO2e emissions per kg of pipe produced within its direct operations and from the energy it uses, i.e. scopes 1 and 2 of the lifecycle analysis.

This is a major project that combines innovation and sustainability and that drives the decarbonization of Tubos Reunidos in terms of its energy efficiency and circularity and the reduction of its environmental footprint. In this context, it is worth noting the unification of the steelworks, which has enabled the first phase of the pipe manufacturing process to take place in a single location, thereby delivering decarbonization efficiencies.

Outlook

The second half is somewhat mirroring the first half of the year, with a focus on developments in the Chinese economy and the US presidential election in November, the result of which will determine whether we see a continuation of the current scenario or a potential return to an insular policy that will again result in measures to protect local industry, in line with increasingly inward-looking trends worldwide. At the same time, the caution displayed by many customers in the face of a possible recession is a factor to be considered in the short-term.

Given the environment of uncertainty, we expect volumes and prices to recover slowly throughout 2025 as actual and apparent demand rebalance as inventories in the sector fall back to normal levels, and as projects related to the generation of energy in all its forms are rolled out more quickly. Through the promotion of decarbonization processes, we also expect to generate considerable demand for O-Next, the first seamless steel pipe on the market with net zero scope 1 and 2 carbon emissions, made from recycled raw materials.

The O-Next pipe, which was unveiled at Tube Düsseldorf 2024 and will enter into production in the second half of the year, has generated considerable interest from our customers owing to the contribution that it could make to their own decarbonisation processes. We expect it to account for an increasingly large part of our portfolio to reflect the industry's direction of travel in that regard.

Finally, the European Central Bank's recent interest rate cut in light of lower inflation is good news that should trigger renewed activity and greater dynamism in the sector in 2025.