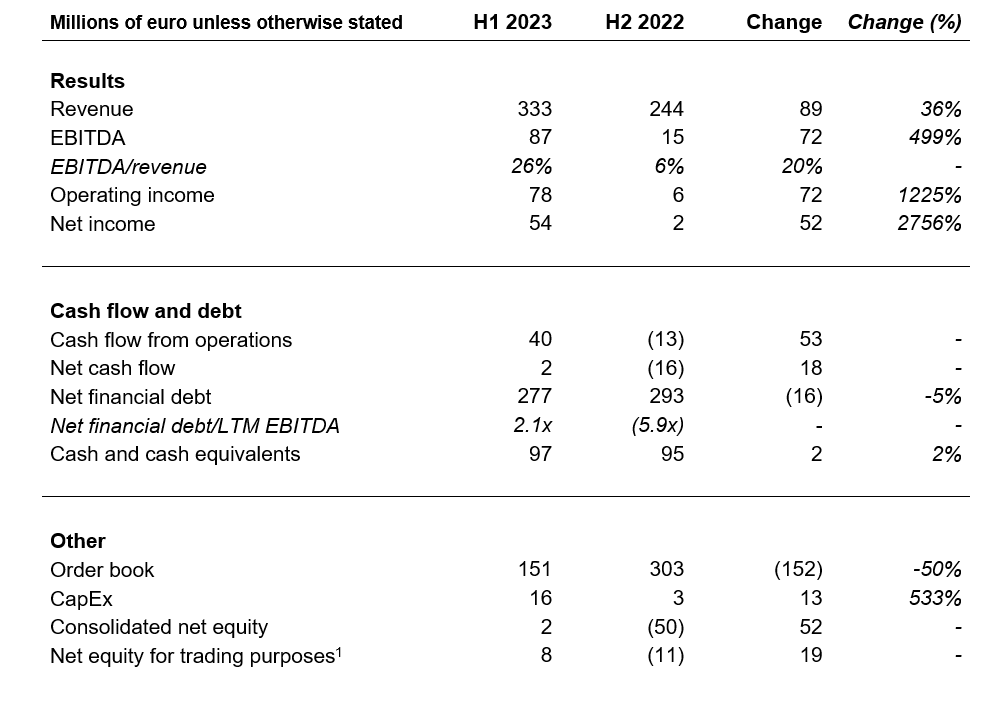

- Revenue for the first half of the year reached EUR 333 million, a 36% increase on EUR 244 million in the first half of 2022.

- EBITDA reached EUR 87 million, delivering a record margin of 26% and exceeding the amount for the corresponding period of the previous year by EUR 72 million. Indeed, this result was EUR 23 million higher than the EBITDA posted for the entire 2022 financial year.

- The net profit of EUR 54.5 million as at 30 June 2023 was EUR 52 million higher than in the same period of the previous year, and is EUR 11 million higher than the net profit for the entire 2022 financial year.

- Positive cash generation reduced net financial debt by EUR 15.7 million to EUR 277.1 million as at 30 June. The ratio of net financial debt to EBITDA improved, falling to 3.1x.

- The order book stood at EUR 151 million at the end of the first half of the year due to market paralysis, particularly in Europe and the United States, caused by excess supply following high prices in recent months.

- With incoming orders likely to be insufficient in the coming months, Tubos Reunidos believes that an ERTE (temporary redundancies) is unavoidable for production reasons.

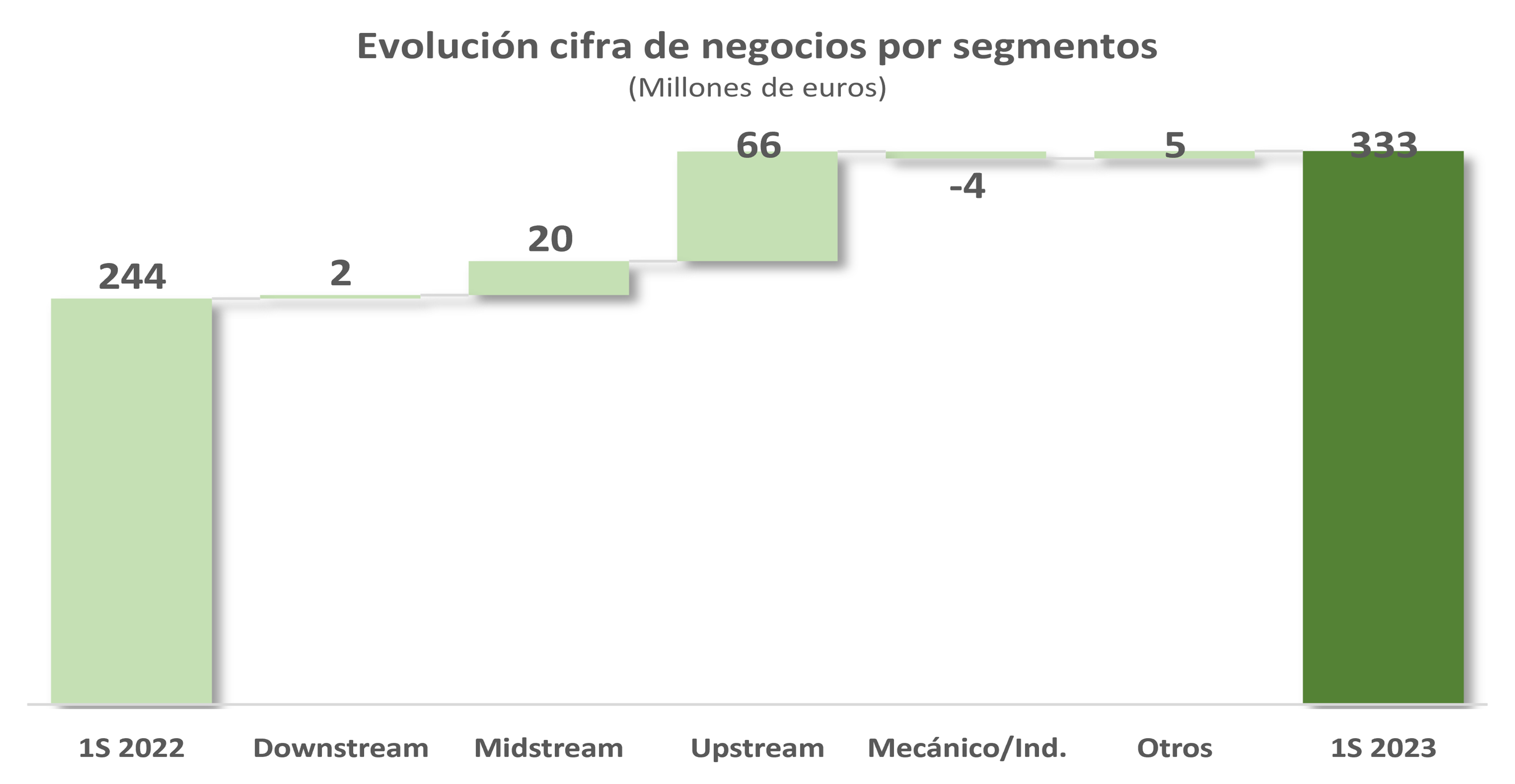

Amurrio, 28 July 2023 – Tubos Reunidos Group has today published its results for the first half of the 2023 financial year, continuing the trend of the last months of the previous year. Revenue for the first half of the year reached EUR 333 million, a 36% increase on EUR 244 million in the first half of 2022, which itself was an improvement on previous years. This increase was primarily the result of high market prices in the last months of 2022 that translated into invoices and orders over the half-year.

[1] Of the Group's parent company

The positive growth in sales was accompanied by cost containment that, together with the efficiency actions of the Strategic Plan, enabled an exceptional profit margin of 26%, a record figure for the company. EBITDA stood at EUR 86.9 million, exceeding the amount for the corresponding period of the previous year by EUR 73 million and generating EUR 23 million more in just six months than the figure for the entire previous year. Net profit reached EUR 54.5 million, compared with EUR 1.9 million in the same period of 2022.

The company has continued to deleverage, with net financial debt falling by EUR 15.7 million to EUR 277.1 million as at 30 June and cash and cash equivalents totalling EUR 104 million. The ratio of net financial debt to EBITDA improved, falling to 3.1x. Comparing to EBITDA over the last 12 months, this ratio fell to 2.1x, a much improved figure and in line with the Strategic Plan.

2021–2026 Strategic Plan:

It is worth highlighting the effort made to implement the investments set out in the Strategic Plan: EUR 16 million over the period. Highlighted among the actions under way due to its impact on achieving the Plan objectives was the work of consolidating the casting processes of the Trápaga and Amurrio steel mills into the latter. This enabled the Amurrio facility to produce both billets and ingots, the raw material for the manufacture of pipes of varying diameters and compositions. Considerable progress has been made in the past six months on works at the new steel mill, with the completion of the warehouse structure and the assemblies, the construction of the casting pit and the first cold testing. The first ingot casting is expected in the second half of the year, along with the gradual transfer of all ingot production from the Sestao factory.

Other investment activities have also been initiated to improve plant efficiency and increase production capacity. We are expanding the heat treatment and threading capacity of the US plant to meet the demand for pipes treated in the US.

Finally, we are undertaking investments related to energy efficiency, mobility and reducing our carbon footprint, in line with the Group's commitments to sustainability.

Sales by geographic area and sector:

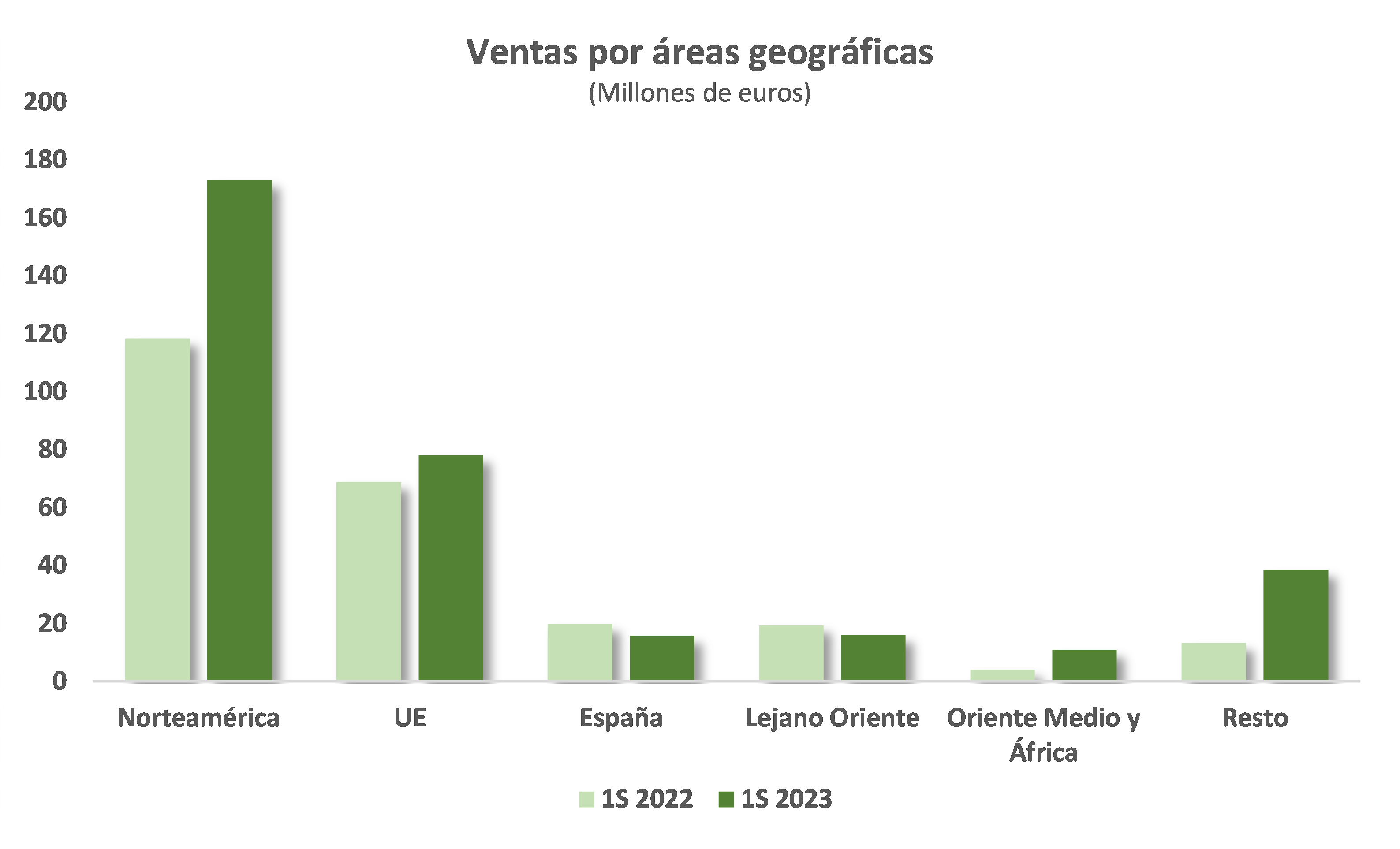

North America remains the Group's main market, accounting for 52% of total sales despite showing a downward trend over the half-year. The European Union was the Group's second-largest market, generating 23% of the Group's total revenue and growing 13% versus the first half of 2022. Also worth highlighting is the strong growth in the Middle East and Africa. Although these territories represent just 3% of revenue, they grew by 174%, reinforcing the strategy of geographical and product diversification.

By sector, sales growth was focused on upstream operations (OCTG), which represented 38% of total revenue, a 104% increase on the first half of 2022, as well as midstream, with a 51% increase. On the other hand, mechanical-industrial piping weakened to a degree and downstream sales remained steady, despite the fact that many projects are pending reactivation amid a high interest rate environment.

The order book stood at EUR 151 million at the end of the first half of the year due to market paralysis, particularly in Europe and the United States, caused by excess supply following high prices in recent months. However, we believe that this is temporary and that the balance between supply and demand will recalibrate. As at 30 June, we have a more balanced order book by sector but with insufficient prospects of incoming orders over the coming months. This makes it unfeasible in the short-term to fill the production capacity of the small tube plant in Amurrio. As a result, the Group has requested an ERTE, which allows it to implement temporary redundancies, in this plant for production reasons.

Renewal of collective agreements:

Major milestones of this period include the completion of negotiations for and the signing of the 2022–2027 collective bargaining agreements for the Amurrio and Trápaga plants.

Exit of the CEO:

On 14 July 2023, the company reported Francisco Irazusta Rodríguez's decision to resign as CEO of the parent company and as a member of its board of directors, effective 31 August 2023, in order to take on a new professional challenge in an international company outside of Spain.

In accordance with the Tubos Reunidos S.A. articles of association and the board of directors' regulations, Deputy Chair Emilio Ybarra Aznar will temporarily assume duties as Chair from 31 August 2023 until a new non-executive Chair of the board of directors is appointed. Carlos López de las Heras will continue to lead the first executive line as Managing Director, a position he has been successfully performing for the company in recent times.

About Tubos Reunidos:

Tubos Reunidos is a company listed on the Spanish stock market, with more than 130 years of experience. It is a global leader in special niche segments of seamless steel pipe products. The Group has four production units in Amurrio and Subillabide (Álava, Spain), Valle de Trápaga (Bizkaia, Spain) and Texas (USA).